AI-Powered Auto Underwriting for Every Dealership

Turn wait times into approvals. Best Call learns from your dealership's lenders, managers, and customers — so even new sales reps can structure deals like seasoned pros. Your finance manager still makes the call, Best Call gives everyone their playbook.

Not a replacement — a force multiplier. Best Call learns from your F&I team to guide your sales team.

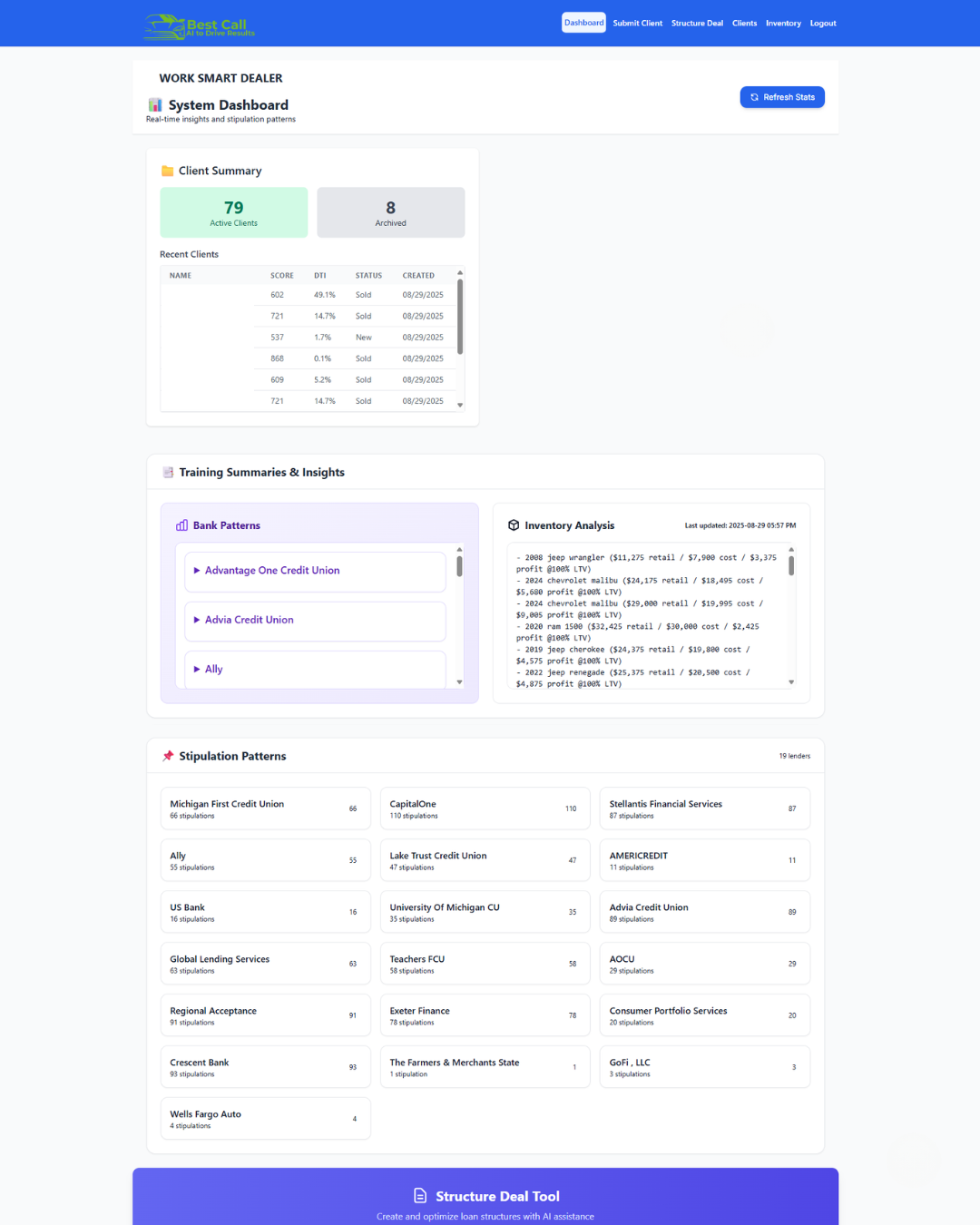

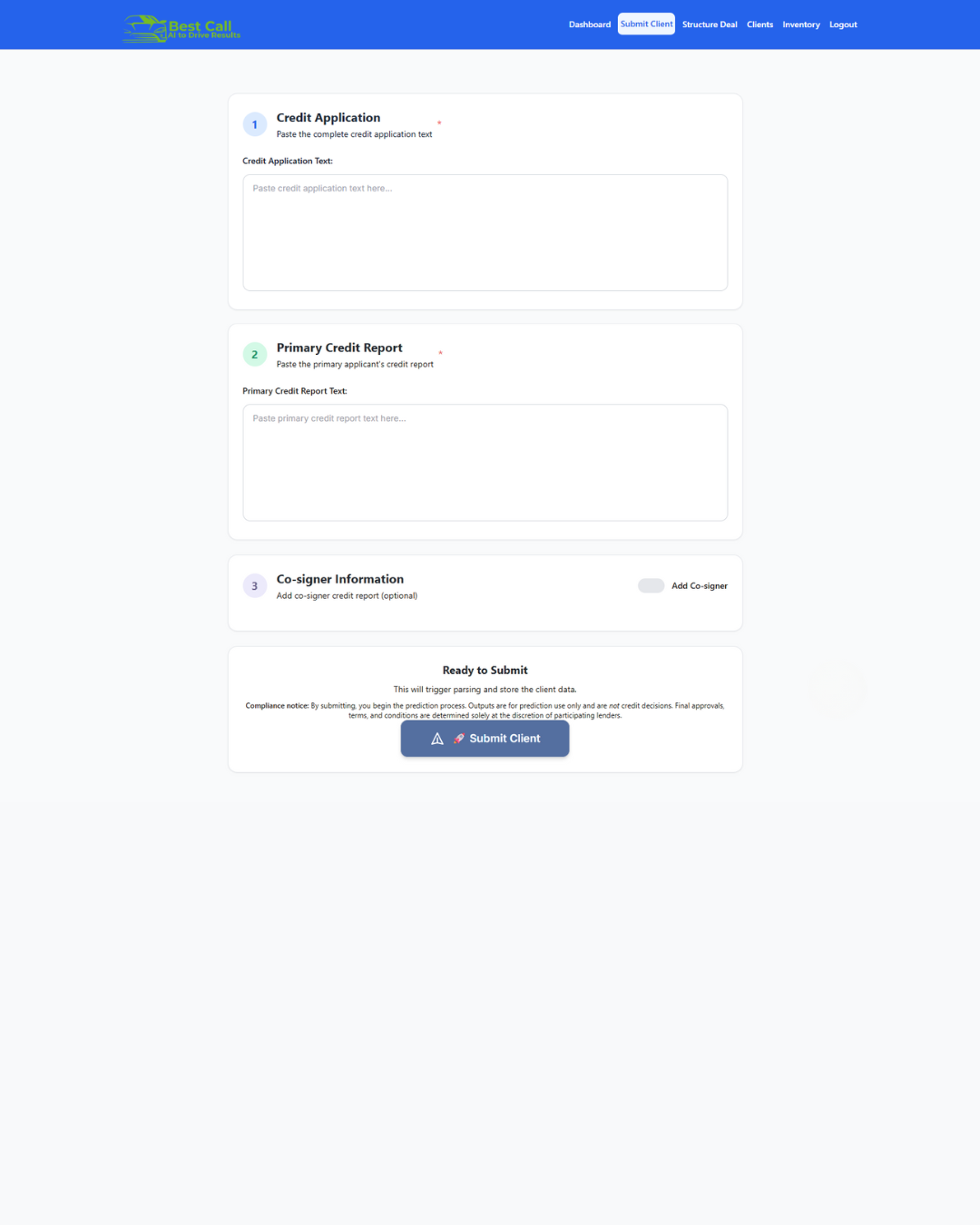

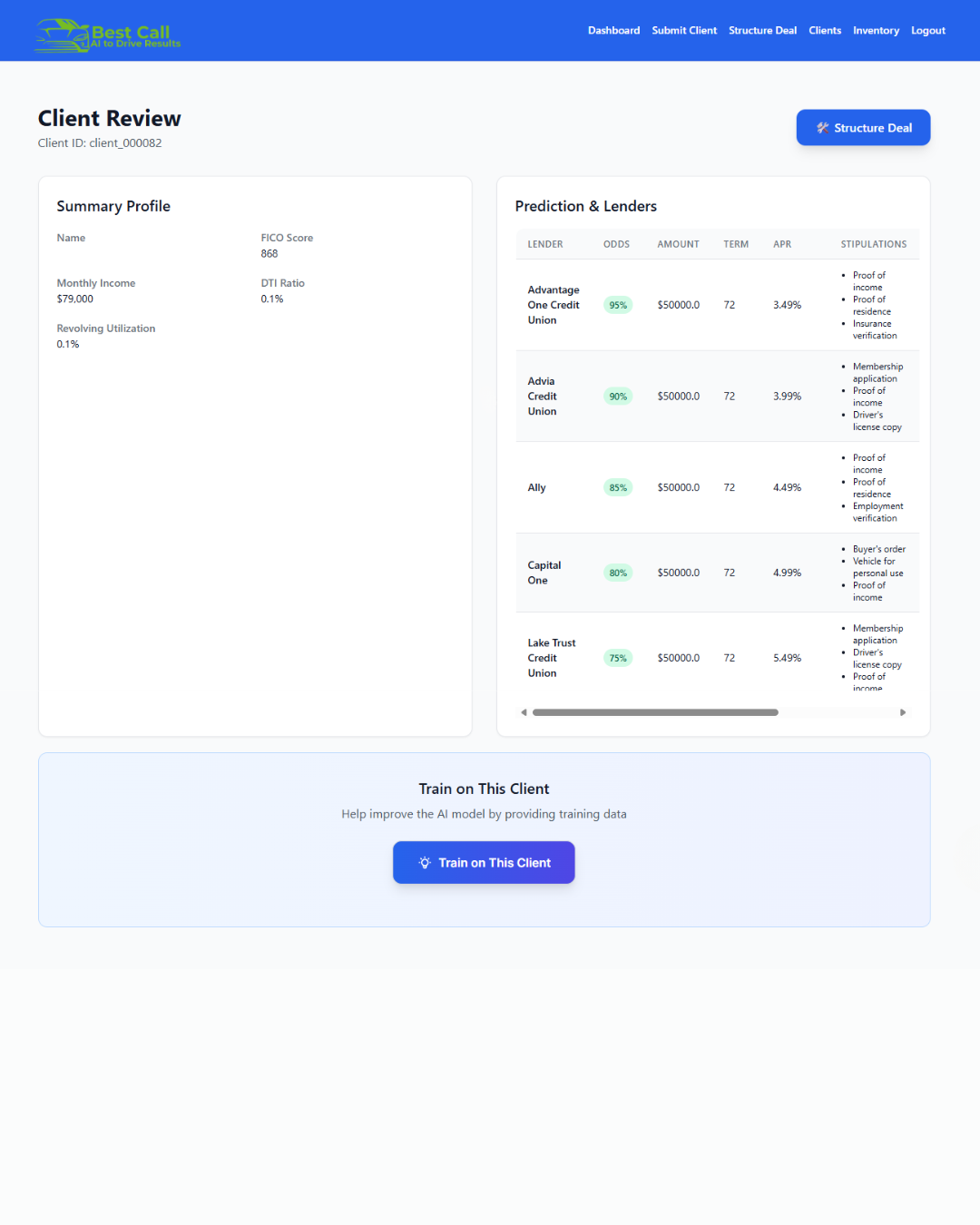

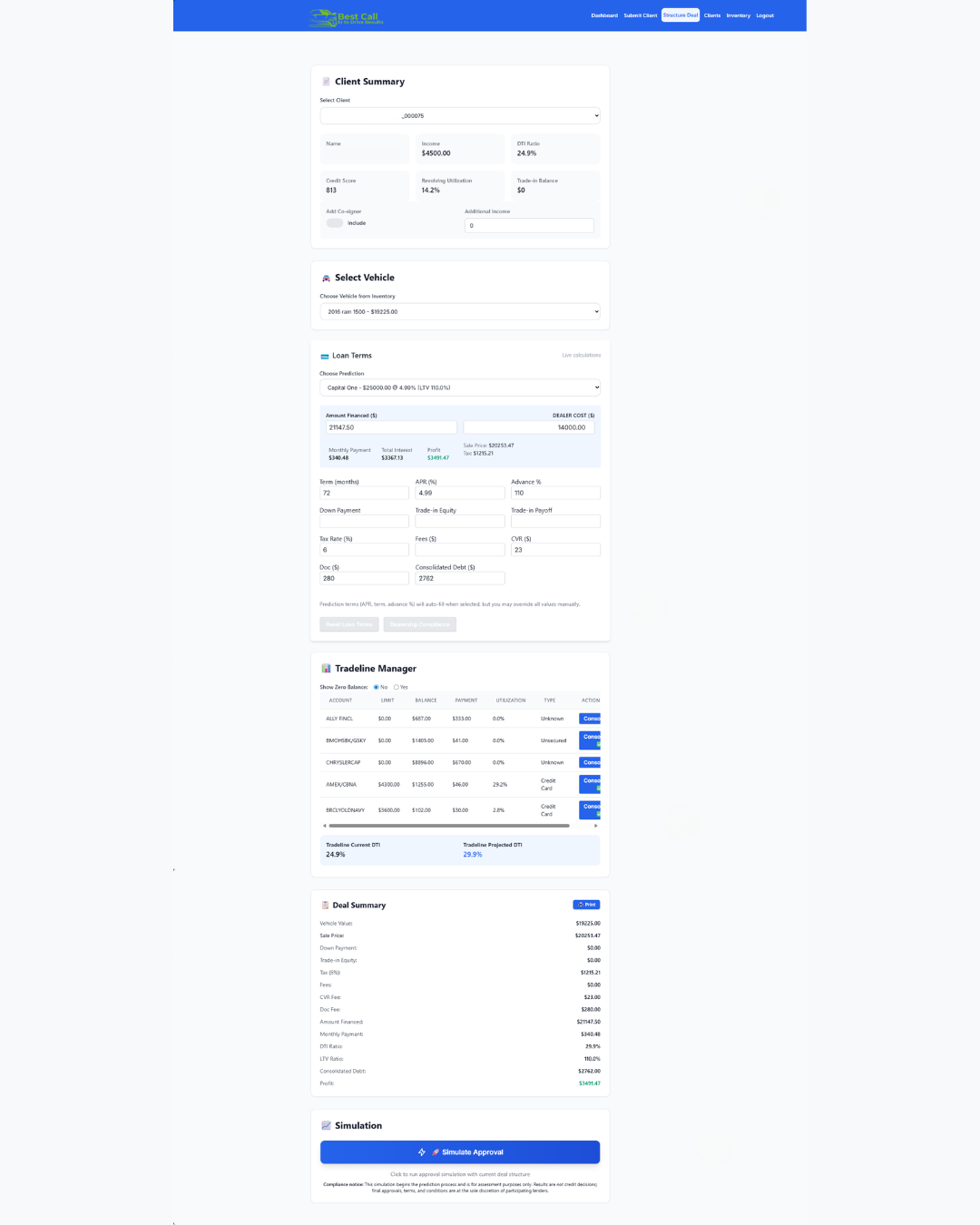

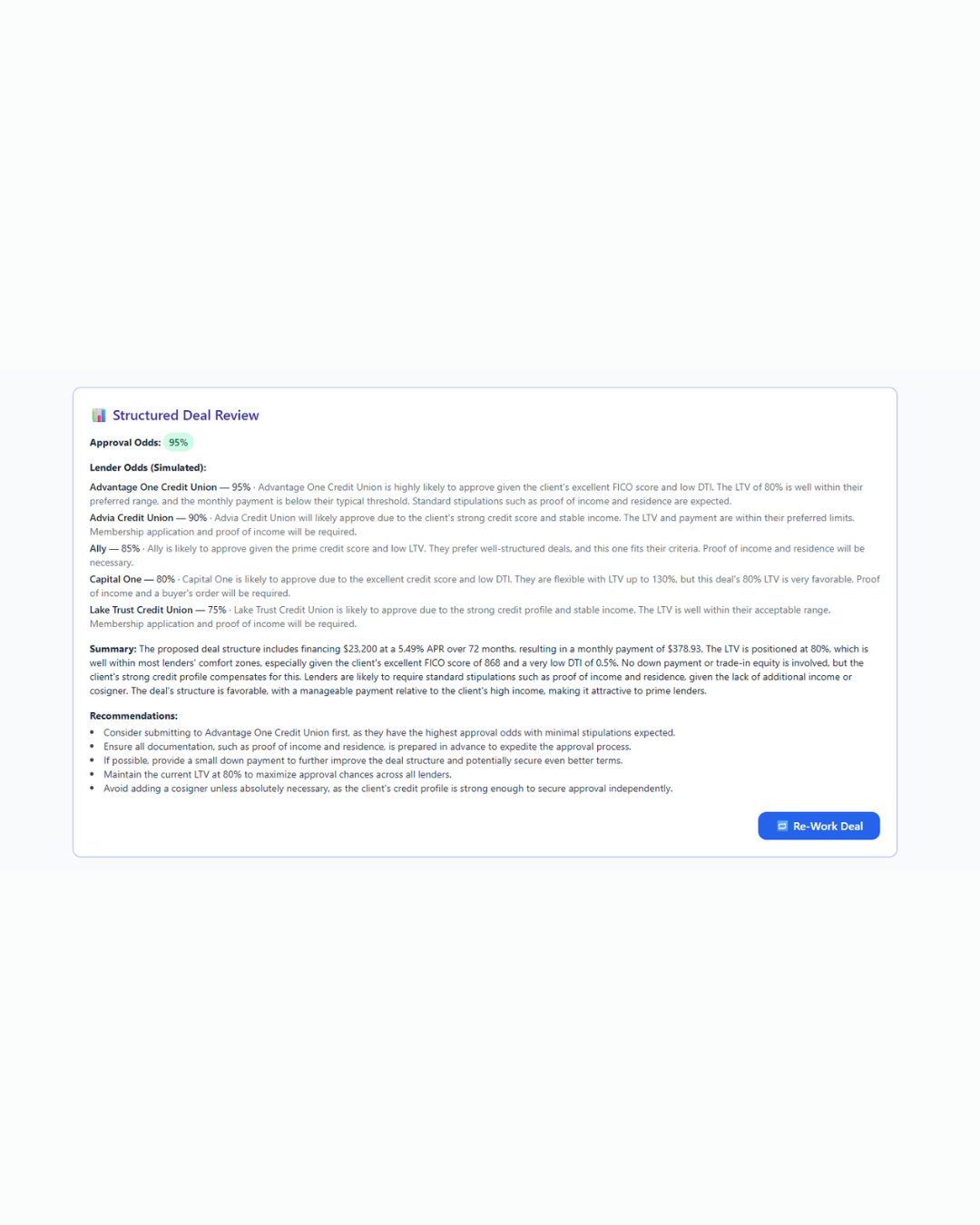

Product screens

Why dealerships choose BestCall

Purpose-built for auto — trained on your lenders, your customers, and your managers.

Trained on Your Store

Learns from your dealership's approvals, lender habits, inventory, and F&I decisions.

Any Rep Can Use It

Train sales staff in minutes. No F&I expertise required to get great outcomes.

Smarter Approvals

Dealership-specific AI surface 5 predictions per deal with real approval odds and lender fit based on your customers profile and your lenders habits.

Boost Profit, Cut Callbacks

Live DTI/LTV, deal simulation, and stip pattern insights reduce rehashing.

Multi-Rooftop Ready

Each store runs on its own secure subdomain with shared oversight.

Enterprise Security

Encrypted end-to-end. Clear compliance controls for lenders and stores.

Train Your Team in Minutes, Not Weeks

If your reps can click, they can use Best Call. The system adapts to your workflow — not the other way around. It learns from your best finance manager and gives your sales team the same insight on every deal.

Ready to Win More Approvals?

Join dealerships already turning declines into approvals with BestCall AUS.